tax on forex trading in south africa

Avatrade are particularly strong in integration including MT4. The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign.

Forex Trading In South Africa 2022 Complete Guide

Forex Trading South Africa has a long-lasting and successful history starting from the 1980s.

. How To Avoid Tax Trading forex In South Africa For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax consideration. In the last years of the decade the market has experienced exceptional growth becoming comparable with leading Forex markets including the United Kingdom Canada Japan and even the US. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short-term capital gains rate.

Forex trading which is done through a registered South African company is subject to a flat tax rate of 28 of its taxable income. This is in contrast to property or currency. Forex is legal in South Africa as long as it does not contravene money laundering laws and traders must declare any profits to SARS South African Revenue Service.

Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns. For this to be done you will also need a tax clearance. South African stocks suffer worst week since 2020.

Forex traders who are seen as South Africa Residents are required to declare all their income and profits from forex trading on their annual tax returns. Simply any profits made from currency trading in South Africa is subject to income tax with forex trading being classed as a gross income. 132 4181 Translation of foreign.

The reason is that if you are seen as a tax resident this means that you will be taxed on all your income local and foreign. South African crypto tax consultants are of the opinion that since SARS has shared examples of capital gains tax disclosures only that this is the lay of the land. In other words 60 of gains or losses are counted as long-term capital gains or losses and the remaining 40 is counted as short-term.

418 Translation of foreign taxes to rand and the determination of an exchange difference on a foreign tax debt. In South Africa however the top marginal personal income tax rate is 45 and top marginal capital gains tax rate is 18. This is strongly advisable as otherwise there might be legal consequences.

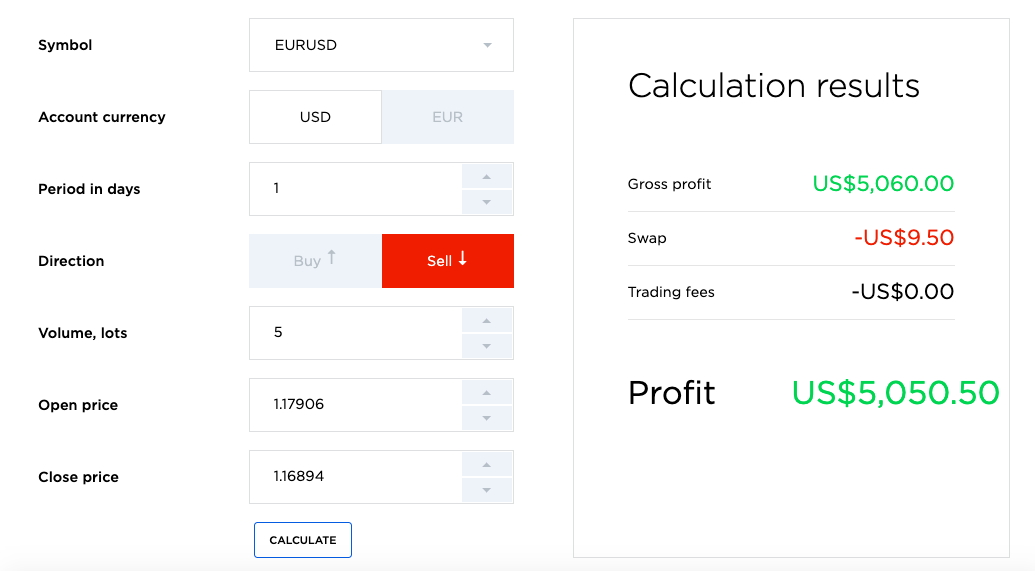

Before this is paid all expenses incurred should be deducted to determine the total taxable amount and as every South African resident is required to pay tax on international income forex traders must declare all their. All expenses incurred from your forex trading must be deducted from the gross income of the trading to calculate the taxable profit from your forex trading. I am trading in forex and would like to know whether I am subject to tax when I bring my earnings into the country.

Therefore a point of great significance. As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income tax tables for an individual. 4 years ago DTVTAuditors.

Crypto Taxes in South Africa. While you do not have to use a regulated broker. FXTM is a leading forex and CFD broker.

Shutterstock A Fin24 user trading in forex writes. Using FSCA regulated brokers is not a legal requirement but other recognized organizations should regulate the brokers used. Top 10 tips to pay less tax.

Forex Traders generally make two types of income commission income and direct FOREX trading gains and losses. However the tax system is very complicated and rules vary from case to case so it is impossible to give one unique solution about how much tax you are going to pay as a forex trader. Therefore local forex traders should keep all documents and records.

South Africa is no different and forex traders have to pay taxes on their profit. A Fin24 user wants to know about tax relating to forex earnings. South African businesses are exposed to foreign currency transactions on a daily basis which invariably cause practical issues around the appropriate foreign exchange rates to be used.

If you want to learn more about Cryptocurrency in South Africa and if you should pay taxes on crypto trading read further below. Offering a huge range of markets and 6 account types they cater to all levels of trader. According to the South African Revenue Service SARS Cryptocurrencies like Bitcoin are considered assets of an intangible nature.

While the Forex market in this region is not a major trading hub like the four big trading sessions it is the major hub in Africa. It is legal to trade Forex in South Africa as the South African Government doesnt have any laws governing the legality. According to Keith Engel he is the CEO of the South African Institute of Tax Professionals SAIT he stated that a Forex Trader is taxed at normal rates of up to 45.

Forex traders who are residing in South Africa are required to declare all their profits from forex trading on their annual tax returns. VAT and Forex. Get a 30 Deposit Bonus - Get an extra 30 on top of your deposit thats up to 200 more to trade with.

Trading Forex in South Africa is legal as long as you declare your income tax and you abide by financial laws that prevent money laundering. Avoiding mistakes is key in learning any new craft. Not only are there often accounting system limitations which in some cases only allow exchange rates to be updated on.

Tax Forex Trading South Africa Jobs From Home Spalding Wie Kann Man Am Meisten Geld Machen Mit 13 Jaehriger Viel Download Was Ist Ethereum Digitalwährung Und Handel 2020 Erklärt 4 Not 5 Forum Indonesia-afrika 2018 Guadagnino Bar Migliori Siti Segnali Forex Tavola Calda Osteria Por Favor Hazme Rico Hazme Rico - Traducción Al Inglés - Ejemplos Español. The South African Reserve Bank control international monetary exchange overseeing outgoing cash-flow from the country 1Trading Forex is legal as long as you abide by financial laws that prevent money laundering 2 and you declare your.

Why Forex Trading Is Exploding Exponentially In Africa Africa Global Funds

15 Best South African Brokers 2022 Comparebrokers Co

8 Most Successful Forex Traders In South Africa 2022

Richest Forex Traders What Can We Learn From Leading Traders

South Africa Forex License Application Tetra Consultants

Is Forex Trading Taxable In South Africa 2022

Realistic Forex Income Goals For Trading

What Is Isr Tax An Vicitm Was Cheated 1 000r By Expert 24 Trade Wikifx

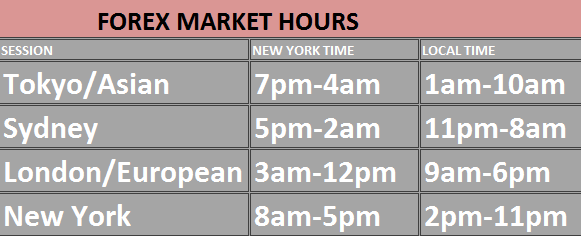

What Are Trading Sessions In South Africa Wheon

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

Exclusive Forex Traders Are Required To Pay Taxes Fx Magazine Research Has Found Forex Magazine

Forex Trading 2022 How To Trade Forex Beginners Guide

Steps To Successful Forex Trading In South Africa Atlas Finances

Your Forex Trading Career In South African Can Scale Higher Than Everbefore With The Right Broke Forex Trading Forex Trading Strategies Forex Trading Training

How Many Individual Forex Traders Are In South Africa Quora

Forex Trading In South Africa 2022 Complete Guide

How Do Forex Traders Pay Taxes Must Watch Youtube

Richest Forex Traders What Can We Learn From Leading Traders